HMRC Refund Scams – Must Read Guidelines and Reminder from GMP Drivercare

Government Agency are always under the microscope or radar of internet criminals, in this article we will talk about ‘HMRC Refund Scams’, Some Examples from HMRC and what are the guidelines of HMRC.

In the past, we have seen many services offered in the name of Government offices by cyber criminals. Out of these Agencies, HMRC is one of the most targeted agency due to the nature of its business. Scammers tried to take advantage by sending out bulking email, texts or automated phone calls to get attention of many people. On the Official Gov.uk Website, HMRC have published some example email addresses from which these scams are sent. Customers should not open any links or give out their personal information on these online forms. Some of these emails are:

- service.refund@hmrc.gov

- secure@hmrc.co.uk

- taxrefund-notice@hmrc.gov.uk

- taxrefund@hmrc.gov.uk

- refund-help@hmrc.gov.uk

- refund.alert@hmrc.gov.uk

- refunds@hmrc.gov.uk

- rebate@hmrc.gov.uk

- HM-Revenue-&-Customs@ztoro.com

What to Avoid? Emails, Automated Phone Calls, SM Direct Messages?

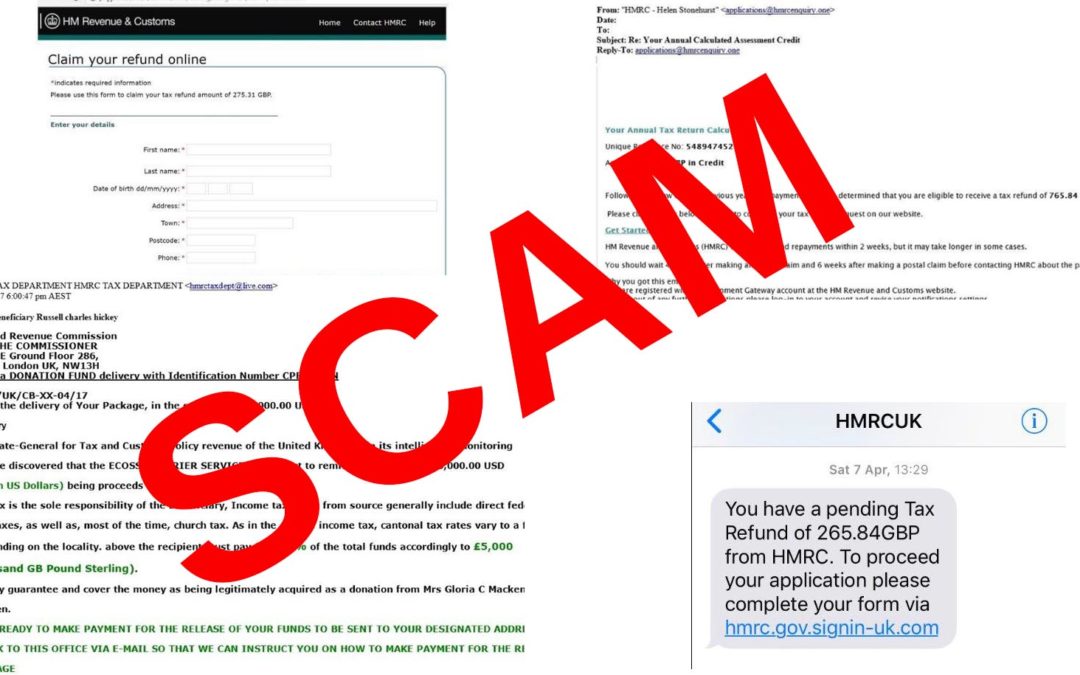

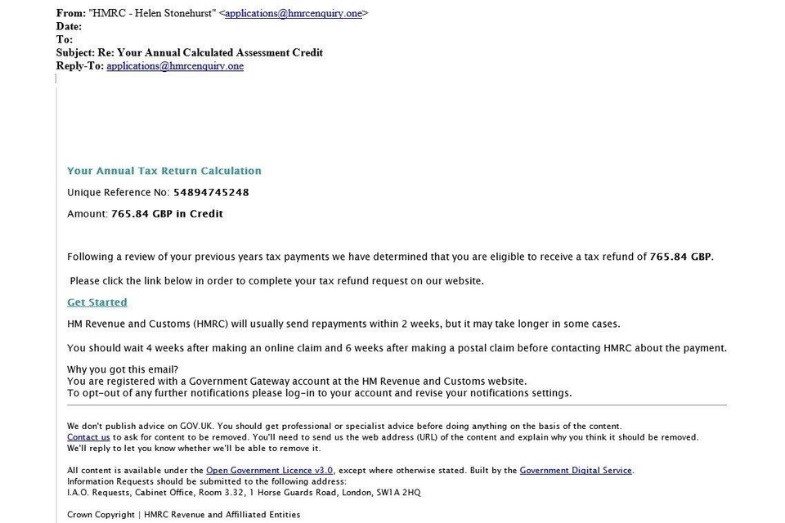

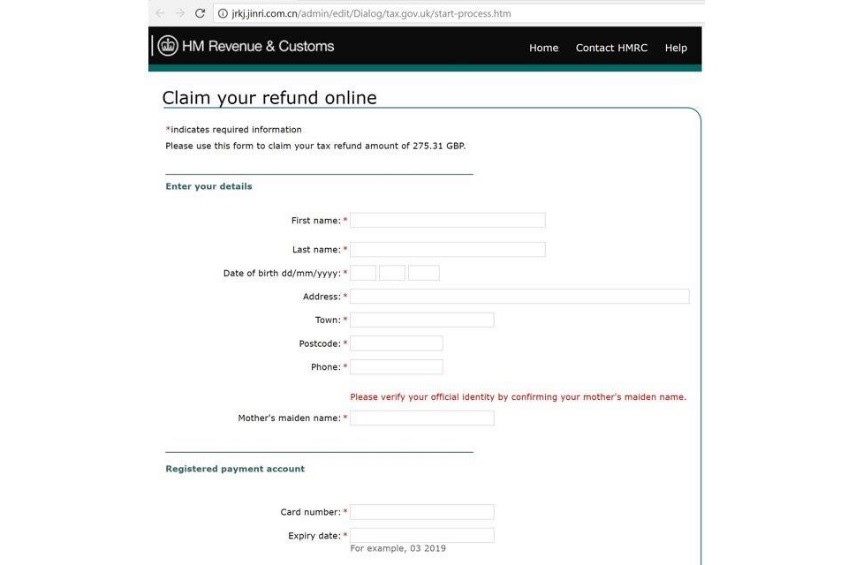

The Email Body of these emails or online forms are also designed in such a way that it looks the same as of HMRC or Gov.uk. Below are some pictures published by GOV.uk in one of their article.

Some of the other examples we have seen in the past are: Text message sent from HMRC or HMRCUK informing that you have a pending tax refund and you must sign in to complete this form. Bogus or Fake Phone calls are also one of the most reported scam technique noticed in the past. The phone calls are threatening and automated call says something like ‘You haven’t paid your tax and there is a lawsuit..’ or ‘You must call this number to avoid paying extra..’. Social Media has also been used by the Cyber Criminals to get attention of people, HMRC mentions Twitter as one of the social media used for such purposes and they have often targeted ‘elderly and vulnerable people’.

How to Report these scams

HMRC mentions on their official GOV.uk website that “HMRC will never send notifications by email about tax rebates or refunds.” However, if you are getting these emails or calls or any other type of scam messages, please do not open any attachments or give out your personal information. For Verification these emails can be sent to phishing@hmrc.gsi.gov.uk, these emails will then be checked by HMRC and they will advise you further. If you are still unsure, it would be a good idea to give a call to HMRC rather than paying money or wasting time due to Scammers and Cyber Criminals. Another Method to contact HMRC is by text message to 60599, HMRC will contact by phone or post to reply your query.

How GMP Drivercare Helps their customers?

GMP Drivercare Limited ‘Looking After all your Motoring Needs’, we help all our customers to avoid these kind of scams, we usually guide our drivers and clients with all the paperwork to avoid any unpaid taxes. Our Experts guide and advise customers from start till end, which provides them confidence and guarantee. We assist organisations in completing these tasks, by saving their time and reducing the allocation of extra resources to complete administrative tasks by employers. If you want to know more about any of our services, please visit https://gmpdrivercare.com or email us at info@gmpdrivercare.co.uk